Transform the way you interact and communicate with clients and prospects by extending your website and sharing content direct to their mobile device.

Drive digital change

Digital transformation within the Accountancy sector is going nowhere – the reality is it’s only going to become even more significant. Customers, consumers and clients have gone mobile and any business or firm without an on-the-go presence is missing out on opportunities. If you have a website and a captive valuable audience then you need to complete your digital transformation and extend your website with your App.

Changing the way your firm communicates and operates can seem a daunting process. However, the risk of not doing so and being left behind far outweighs any benefit of staying as you are with old ways of working – which simply won’t be an option in years to come. It’s important you put the steps in place now to futureproof.

Neutralise the ‘Google effect’

Digital sharing of data means you can no longer rely on local business or client loyalty to fuel your pipeline. In today’s 24/7 mobile world, your position as the first point of contact to discuss financial issues, is being challenged. Numerous alternative sources of information are just a few taps away on a smartphone or tablet – and many people turn to Google or other search engines before anything else.

Relentless pressure to do more with fewer resources forces clients and prospects down the quickest and easiest route to information on accounts, finance and tax. By delivering this through a custom, branded App, you can neutralise threats such as ‘the Google effect’ and cement your position as your clients’ trusted adviser. Embracing digital mobile will ensure you and your clients are connected when and where it matters.

Extend your website

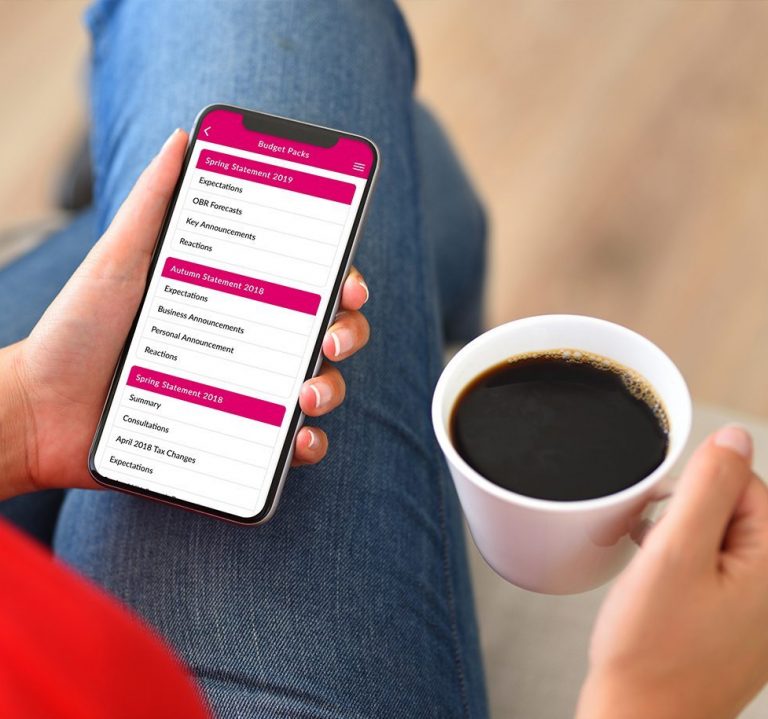

You can extend the reach and impact of your website with your own App. An App is effectively a mobile extension of a website and can massively boost the reach and effectiveness of content. You can send or store important content via your App and make it easily accessible, searchable and available 24/7 to your clients.

Even if your website is mobile responsive you still need an App to complement it- Apps are “native” to the device on which they are designed to run on, which means they load and operate faster than a responsive website on the same device. Additionally, an App doesn’t need an Internet connection to work, which means it can always be opened and used.

You can own the digital journey

One of the easiest ways to drive digital adoption within your firm is through your own App, as once clients start using it, they’ll see the huge benefit of digital processes and how using your App will make their daily business lives and communication with you far more streamlined.

OneApp allows you to communicate with clients like never before. Now you can provide a constant stream of useful content, collect valuable data conveniently, and contain everything together in one place, All this, in your firm’s branding and in the palms of your clients’ hands.

Your digital future made simple

The prospect of making your firm more digital and supporting existing and new clients with digital adoption can seem like the most complex and time consuming task of your career, but it doesn’t have to be. Having your firm’s App can be the key to success – it will drive digital behaviour for you.

“”We’re in changing times where access to information needs to be fast and accurate. Clients are more savvy with the latest software and having an App shows them that our firm is on the same page. We have had very positive feedback”.”

Khan Morris Accountants